Published: January 22, 2026

You want practical ways to strengthen your portfolio as markets shift in 2026, and Silver deserves a place in that conversation. Silver can offer liquidity, inflation protection, and diversification that complements stocks and bonds. This guide focuses on straightforward tips and a curated set of coins so you can make informed choices that match your goals and budget.

Category |

Product |

Price |

Score |

|---|---|---|---|

🏆 Best Overall |

$134.99 |

96/100 |

|

💰 Best Value Antique |

$79.95 |

78/100 |

|

⭐ Best Gift |

$134.99 |

92/100 |

|

🎖 Best For Collectors |

$107.99 |

90/100 |

|

💼 Best Encapsulated |

$134.99 |

94/100 |

|

🚀 Best Type 2 Debut |

$134.99 |

90/100 |

|

🔰 Best Mint State Option |

$134.99 |

90/100 |

|

🎯 Best Recent Issue |

$134.99 |

96/100 |

You need selection rules that match real investing goals, so we weighed authenticity, metal purity, condition, liquidity and value versus spot price. We favored coins with .999 or historically trusted fineness, clear provenance or protective encapsulation, and entries that balance collector appeal with resale potential.

Price accessibility and packaging that preserves condition were also important because those factors affect long-term value and ease of sale.

You get a one ounce .999 fine Silver coin presented in gem brilliant uncirculated condition, shipped with a Certificate of Authenticity. This piece works well if you want a liquid bullion stake with collector appeal or a standout gift for milestones. You can hold it as a hedge against inflation, use it to diversify away from paper assets, or add it to a numismatic collection without sacrificing liquidity.

If you want a modern American Silver Eagle that balances investment practicality and visual appeal, this is an easy choice.

Customers commonly note the coin arrives in uncirculated, well-protected condition and appreciate the crisp new eagle reverse and Liberty obverse. Many buyers highlight the packaging and on-time delivery, and a lot of people pick this as a meaningful gift. A recurring comment is that the price sits above spot Silver, but most feel the quality and certification justify the premium.

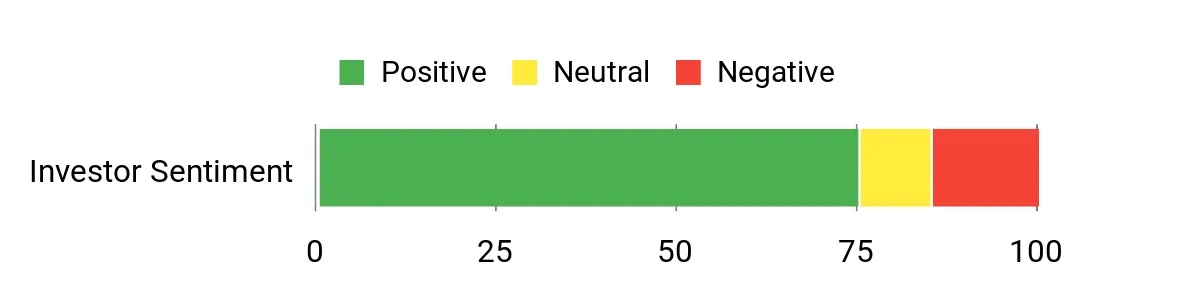

Overall Sentiment: Positive

Holding this Silver coin can protect purchasing power over time and provide liquidity when you need it. Collector interest in mint-state issues and modern design changes can add premiums beyond metal value, especially if you buy and hold through market cycles.

Your baseline return will track Silver spot, so short-term gains depend on market moves and dealer premiums. Over time, the combination of bullion value and potential numismatic premiums for mint-state coins can improve returns compared with raw spot exposure, especially if you buy at reasonable premiums and store securely.

Situation |

How It Helps |

|---|---|

Gifts and Milestones |

The presentation and Certificate of Authenticity make this coin a memorable, tangible keepsake that still holds intrinsic Silver value. |

Portfolio Diversification |

You add a liquid physical asset that tends to move differently than stocks and bonds, helping reduce overall portfolio volatility. |

Starting or Expanding a Collection |

A modern, mint-state American Eagle is a recognizable building block for a collection and easy to trade if you want to rebalance. |

This coin fits multiple roles: bullion for stacking, a collectible for display, and a gift for special occasions. You can move it quickly on secondary markets or keep it long term.

The coin carries US Mint artistic lineage and is sold with a seller-issued Certificate of Authenticity that many buyers find reassuring. That combination supports resale and confidence for both new and experienced buyers.

Silver mining has environmental impacts, and individual listings rarely provide full sourcing transparency. If eco credentials matter to you, look for dealers who disclose sourcing or offer recycled metal options.

Current Price: $134.99

Rating: 4.8 (total: 344+)

Learn More

You get a piece of American coin history with a circulated Morgan Dollar that also contains real Silver value. These coins work well if you want affordable exposure to silver with a collectible angle, whether you’re filling a change jar for stacking, showing a historical piece to friends, or gifting a vintage coin. Expect visible wear and varied condition, but also reasonable pricing for the metal content and charm that comes with an older strike.

Buyers often praise the vintage look and the sense of value when the coin’s wear matches expectations, and many appreciate getting silver at a lower premium than modern bullion. Some shoppers note inconsistent condition across listings and urge checking descriptions carefully, and a portion of customers question authenticity when images or descriptions are unclear.

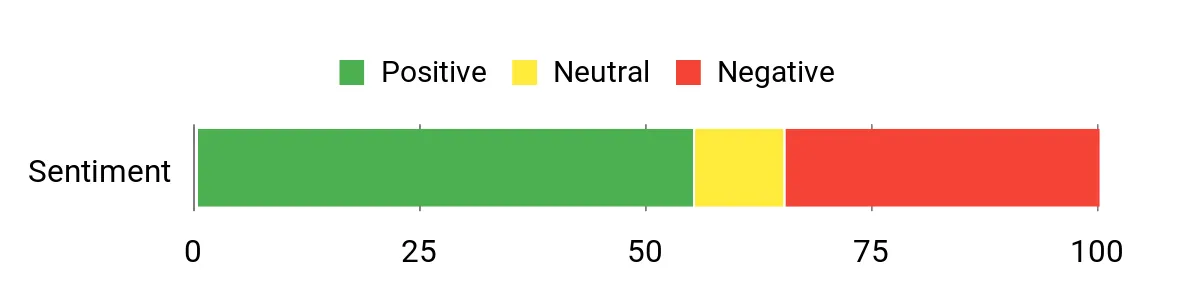

Overall Sentiment: Neutral

Because these are circulated and priced closer to silver spot, you can assemble a physical silver position without high premiums. Long-term upside depends more on collectible demand and rarity for specific dates than on metal alone.

Your return will largely track silver prices, with occasional numismatic bumps for rarer dates or better-preserved examples. Expect modest bullion returns and variable collector-driven appreciation.

Situation |

How It Helps |

|---|---|

Budget Stacking |

Gives you affordable silver exposure without paying modern bullion premiums, so you can add ounces on a tighter budget. |

Teaching and Display |

The historical design and age make it a good conversation piece for showing how coinage and Silver have been used over time. |

Starter Collections |

Serves as an accessible entry point for new collectors who want recognizable dates and designs without large upfront cost. |

This coin crosses use cases: a low-premium way to hold silver, a learning piece for collectors, and a tangible gift with historical character. It’s not ideal if you need pristine, graded examples.

Listing cites United States Mint designs and historic production, which supports recognition, but mixed-year and circulated conditions mean you should buy from reputable sellers and verify descriptions.

Silver production has environmental impacts and older coins don’t carry sourcing labels; if sustainability matters, consider dealers who disclose sourcing or recycled options.

Current Price: $79.95

Rating: 3.9 (total: 617+)

Learn More

You get a modern American Silver that blends bullion utility with collector interest. The Type 2 reverse update makes this coin notable for both stacking and display, and the mint-state finish keeps it attractive to buyers. Use it to add liquid physical Silver to your portfolio, give as a meaningful gift, or start a type-focused collection.

If you want a contemporary piece that’s easy to resell and still visually interesting, this is a practical pick.

Buyers frequently appreciate the fresh reverse design and mint-state appearance, noting the coin arrives well protected. Many mention it’s a nice balance between investment-grade Silver and a piece that looks good on display.

A few shoppers point out dealer premiums, but overall people value the presentation and recognizability.

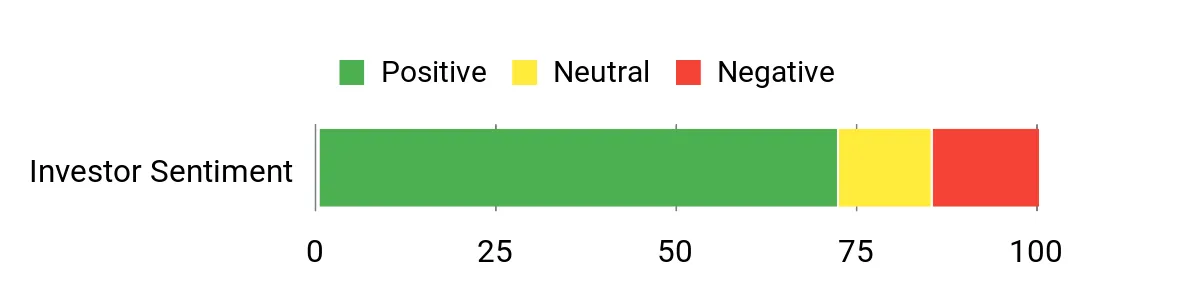

Overall Sentiment: Positive

Holding this Type 2 Silver Eagle gives you exposure to silver spot while also offering potential numismatic interest tied to the design change. Over time that collector attention can add modest premiums above metal value if condition and demand align.

Your baseline return will track Silver prices, but the Type 2 debut can attract buyer premiums for mint-state examples. Buying at reasonable premiums and storing securely improves your chances of positive returns when you sell.

Situation |

How It Helps |

|---|---|

Portfolio Hedging |

Adds a liquid, tangible Silver holding that can move differently than stocks and bonds, reducing portfolio concentration risk. |

Gifts and Milestones |

The updated design and certificate make it a memorable, tangible gift that still retains intrinsic metal value. |

Type-Focused Collecting |

Ideal if you’re completing a series or seeking the first issues of a design change, with good resale recognition. |

This coin works as bullion for stacking, a display piece for collectors, and a gift for special occasions. It’s easy to trade and fits multiple investing and collecting goals.

The American Silver Eagle program has long recognition and the Type 2 update comes from established Mint designs, which helps with resale and buyer confidence when paired with proper documentation.

Silver mining has environmental impacts and listings rarely detail sourcing. If sustainability is a priority, look for dealers that provide sourcing transparency or recycled metal options.

Current Price: $134.99

Rating: 4.5 (total: +)

Learn More

You get a well-presented 1 oz .999 fine Silver coin that balances bullion value with visual appeal. It’s ideal if you want something that works as a tangible investment, a polished display piece, or a meaningful gift for milestones. The gem brilliant uncirculated finish and protective holder mean it arrives ready for a collection or safe storage, and the recognizable American Eagle design keeps resale straightforward.

If you want an attractive, fuss-free way to add Silver to your holdings or mark a special occasion, this one fits the bill.

Customers frequently mention the coin’s bright appearance, secure packaging, and suitability as a gift. Many buyers appreciate that it arrives in protective packaging and looks like a premium piece, while a few comment on shipping costs or dealer premiums versus spot Silver.

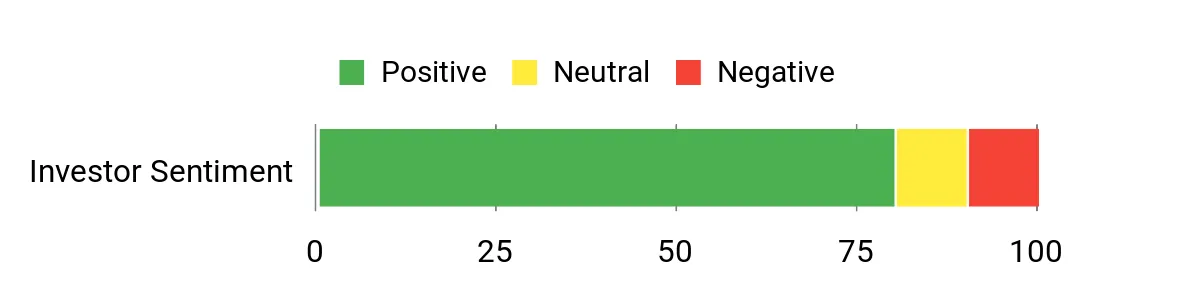

Overall Sentiment: Positive

Holding this Silver Eagle gives you exposure to the spot price of Silver while also offering modest numismatic appeal for mint-state modern issues. Over time that combination can preserve purchasing power and occasionally earn small premiums above metal value.

Your primary returns will track Silver spot, but condition and demand for mint-state Eagles can add incremental value. Buying at reasonable premiums and storing securely tends to improve your long-term outcomes.

Situation |

How It Helps |

|---|---|

Gift Giving |

A polished, certified coin that works as a thoughtful keepsake while retaining intrinsic Silver value. |

Core Bullion Holding |

Provides one-ounce Silver exposure in a recognizable, liquid form that’s easy to buy and sell. |

Display And Collecting |

Gem uncirculated finish and modern reverse design make it attractive for showcases and beginner collections. |

This coin works across uses: as stackable bullion, a presentable collector piece, and a straightforward resale asset. That flexibility is useful whether you’re building ounces or gifting a keepsake.

The American Silver Eagle program is widely recognized and the design lineage supports resale. The seller-provided Certificate of Authenticity adds buyer confidence when purchasing modern Silver coins.

Silver mining has environmental impacts and individual listings rarely disclose sourcing. If sustainability matters to you, look for dealers with clear sourcing or recycled metal options.

Current Price: $134.99

Rating: 4.6 (total: 191+)

Learn More

You’re looking at a true collector staple that also carries tangible Silver value. This 1921 Morgan is best if you want a historically significant coin that’s affordable compared with high-grade collectibles, useful for both display and bullion exposure.

Expect visible circulation with good design elements still readable, and treat purchases as mixed between a small numismatic play and practical silver holding. If you want a recognizable piece that’s easy to trade and pleasant to show off, this is a solid pick.

Buyers commonly praise the coin’s classic appearance and feel that many examples meet expectations for circulated pieces. Reviews note occasional surprises in condition, so shoppers advise checking listing details closely.

Many appreciate receiving a piece that looks authentic and carries both collectible charm and silver content.

Overall Sentiment: Positive

This coin gives you physical Silver exposure at a lower entry price than many modern bullion coins, and certain dates or better-preserved pieces can gain numismatic premiums over time. For budget-conscious investors, it’s a reasonable way to accumulate metal with some upside from collector interest.

Your baseline return will follow Silver spot value, with occasional additional gains if you find scarce dates or unusually well-preserved examples. Expect variable numismatic appreciation rather than consistent premium growth.

Situation |

How It Helps |

|---|---|

Budget Stacking |

Lets you add physical Silver at a lower premium, so you can build ounces without paying modern bullion markups. |

Display And Education |

Classic design and age make it a good conversation piece for teaching or showcasing historical coinage. |

Collector Starter |

Provides an accessible entry into Morgan collecting where you can hunt for dates and grades over time. |

This Morgan works as a low-premium silver holding, a display piece for history-minded collectors, and a stepping stone toward higher-grade numismatics, though it’s not a substitute for certified high-grade coins.

Design and historic minting tie back to U.S. Mint-era production, but circulated and mixed-year listings mean you should buy from reputable sellers and verify descriptions before purchasing.

Older coins don’t carry sourcing details and silver mining has environmental impacts; if sustainability matters, seek dealers who disclose sourcing or offer recycled metal options.

Current Price: $107.99

Rating: 4.5 (total: 164+)

Learn More

You get a one-ounce .999 fine Silver American Eagle presented in a direct-fit Air-Tite capsule that keeps the coin protected and display-ready. This is a practical choice if you want liquid bullion with collector appeal, need a specific year to complete a set, or prefer coins that arrive in near-mint condition.

The Walking Liberty design is timeless, the capsule reduces handling risk, and the seller-provided certificate adds a layer of provenance for gifting or resale. If you value condition and easy storage alongside Silver exposure, this coin fits a range of goals.

Buyers frequently highlight the coin’s brilliant uncirculated look and appreciate the secure Air-Tite packaging that prevents dings. Many mention fast shipping and that the piece meets expectations for condition and year specificity, while some note dealer premiums above spot price.

Overall Sentiment: Positive

Holding a well-preserved mint-state Silver Eagle can protect purchasing power and retain liquidity; over time you may see small numismatic premiums beyond spot for desirable years kept in excellent condition.

Your core return will track Silver spot, but the capsule and mint-state condition can help capture modest collector premiums when demand is strong. Buying at sensible premiums and storing securely improves the chance of positive outcomes when you sell.

Situation |

How It Helps |

|---|---|

Portfolio Hedging |

Adds a liquid physical Silver holding that can act as a hedge against inflation and currency volatility. |

Collector Completion |

Ideal for filling a year-specific gap with a mint-state example that’s ready for display or grading later. |

Gifting |

The protected presentation and certificate make it a memorable, tangible gift that still holds intrinsic Silver value. |

This coin works as stackable bullion, a presentable collector piece, and a gift — its capsule and finish make it easy to store, show, or resell depending on your needs.

The American Silver Eagle design and US Mint lineage are widely trusted; the seller’s Certificate of Authenticity adds reassurance, though it does not replace official Mint documentation.

Silver mining has environmental impacts and individual listings rarely provide sourcing details; if sustainability matters to you, consider dealers who disclose sourcing or offer recycled metal options.

Current Price: $134.99

Rating: 4.7 (total: 272+)

Learn More

You get a one-ounce .999 fine Silver American Eagle finished in gem brilliant uncirculated condition and sealed in an Air-Tite capsule to protect the coin. It’s a practical choice if you want a mint-state piece that’s ready for display, easy to store, and simple to trade.

Use it to add liquid Silver to your holdings, complete a type-focused set, or give as a refined gift that still retains intrinsic metal value. If condition and presentation matter to you, this version balances collectibility with clear bullion backing.

Customers commonly praise the coin’s brilliant appearance and the secure Air-Tite packaging that reduces the risk of dings during transit. Many buyers appreciate receiving a specific year and type in near-mint condition and note that presentation makes it suitable for gifting.

A few shoppers mention dealer premiums and advise checking seller details, and there are occasional reports that encourage careful verification of authenticity.

Overall Sentiment: Positive

Holding a mint-state Type 2 Silver Eagle gives you exposure to Silver spot while preserving condition that can attract small collector premiums over time. Good storage and buying at reasonable premiums help protect long-term value and resale flexibility.

Your base return will follow Silver prices, but the Type 2 design change and mint-state condition can add incremental resale value when demand is strong. Treat it as a blend of bullion and collectible potential rather than guaranteed numismatic appreciation.

Situation |

How It Helps |

|---|---|

Portfolio Hedging |

Adds a liquid physical Silver holding that can reduce exposure to paper assets and inflation risk. |

Type-Focused Collecting |

Serves as an accessible first-issue or type-completion piece thanks to the reverse redesign. |

Gift Giving |

The capsule and certificate make it a presentable keepsake that also preserves intrinsic metal value. |

This coin works as stackable bullion, a display-worthy collector piece, and a giftable keepsake, making it useful across investing and personal-use scenarios.

The American Silver Eagle lineage and recognized design help with resale and confidence; the Air-Tite presentation and seller certificate further reassure buyers, though official Mint documentation remains the strongest provenance.

Silver mining has environmental impacts and individual listings rarely disclose sourcing. If sustainability matters, look for dealers that provide sourcing transparency or recycled-metal options.

Current Price: $134.99

Rating: 4.5 (total: 208+)

Learn More

You get a one-ounce .999 fine Silver American Eagle that marks the Type 2 reverse change, presented in gem brilliant uncirculated condition. It works well as a liquid bullion piece, a display coin for your collection, or a thoughtful gift that also holds intrinsic value.

The smaller holder and tidy presentation make it easy to store or show, and the updated reverse gives the coin extra collector interest without sacrificing resale practicality.

Buyers commonly praise the crisp appearance and the protective packaging that keeps the coin in near-mint condition. Many appreciate the updated reverse design and that the piece is ready for display or gifting, while a few comment on dealer premiums versus spot Silver.

Overall Sentiment: Positive

Holding a Type 2 Silver Eagle offers exposure to Silver spot plus potential modest numismatic premiums tied to the design change, especially for well-preserved examples kept in protective holders.

Your core returns will track Silver prices, but mint-state Type 2 examples can attract extra value when demand for the design is high. Buying at reasonable premiums and storing securely improves resale prospects.

Situation |

How It Helps |

|---|---|

Portfolio Hedging |

Adds a liquid physical Silver holding that can balance risk in a diversified portfolio. |

Type-Focused Collecting |

Serves as a recognizable first-issue or key type piece for collectors completing a series. |

Gift Giving |

The presentation and certificate make it a memorable keepsake that still retains intrinsic metal value. |

This coin is versatile as stackable bullion, a display-ready collectible, and a giftable keepsake, making it useful across investing and personal occasions.

The American Silver Eagle program is widely recognized, and the Type 2 update comes from established Mint designs; the seller certificate adds reassurance though official Mint documentation is strongest provenance.

Silver mining has environmental impacts and individual listings rarely disclose sourcing; if sustainability matters, look for dealers that provide sourcing transparency or recycled-metal options.

Current Price: $134.99

Rating: 4.5 (total: 59+)

Learn MoreThat depends on your goals and risk tolerance, but many investors treat Silver as a complement to stocks and bonds rather than a primary holding. Consider allocating a small percentage of your overall portfolio to precious metals and then decide how much of that should be Silver based on liquidity needs, storage comfort, and your view on inflation.

If you want a practical starting point, think in terms of small, regular purchases so you build exposure over time rather than trying to time short-term moves.

Check measurable details like weight, diameter and stated purity, and buy from sellers with clear provenance or a track record you trust. For modern coins look for markings such as .999 fine and one-ounce weight, request a Certificate of Authenticity when available, and compare the listing ASIN or seller information against reputable dealers. Expect to pay a premium over spot for verified pieces — for example, modern American Silver Eagles often sell around $134.99 depending on market conditions — so factor that into your decision.

Store Silver in a way that balances security, cost, and accessibility: a home safe is convenient but offers less protection than an insured bank safe deposit or a professional vault service that charges fees. Use protective capsules like Air-Tite to prevent damage, keep receipts and certificates for provenance, and consider insurance for larger holdings. When you sell, compare offers from local dealers, online bullion platforms and auction sites so you can judge the best net price after fees and shipping.

You usually prioritize whether you want pure bullion liquidity or historical, collectible character: modern Eagles like the 2025 and Type 2 offer .999 Silver, recognizability and protective presentation for easier resale, while Morgan Dollars deliver vintage appeal and lower entry cost at .900 fineness. You also weigh premiums, condition and provenance—if gifting, storage or completing a type set matters you’ll favor mint-state Eagles with certificates; if budget stacking and history are your focus, Morgans are a practical choice.

You can use Silver to diversify risk, hedge inflation, and add liquid, tangible assets to your holdings. Focus on verified purity, reputable sellers, and condition when you buy, and consider a mix of bullion and collectible pieces to balance liquidity and upside.

Keep purchases aligned with your timeline: stack common bullion for near-term liquidity and choose graded or historic coins for potential collector premiums. Finally, manage costs by watching the spot price, using dollar-cost averaging, and storing coins securely so your Silver investments perform for you through 2026 and beyond.