Protect Your Collection: Top Trading Card Sleeves for the New Year

Shield your trading cards this New Year with our top picks for sleeves, ensuring maximum protection and preservation for your valuable collection.

Published: November 24, 2025

When you prepare for the holiday season, making sure your auto coverage fits your unique needs is essential. Personalized auto insurance helps protect you from unexpected costs and gives you peace of mind whether you're traveling to visit family or running seasonal errands. Understanding your options allows you to save on premiums and select coverage that truly matches your lifestyle and driving habits. This guide will walk you through key considerations so you can make confident choices for your car insurance during the busiest time of year.

You want coverage that adapts to how you drive and what you need, especially during the holiday season when your travel plans might change. Allstate Auto Insurance gives you flexible options for comprehensive, liability, and collision coverage, so you’re protected whether it’s a quick trip to see family or a longer road journey.

They also offer discounts that can help reduce what you pay, making it easier to personalize your plan without stretching your budget. The coverage works well for daily drives but shines when you need that extra peace of mind on special trips or busy holiday roads.

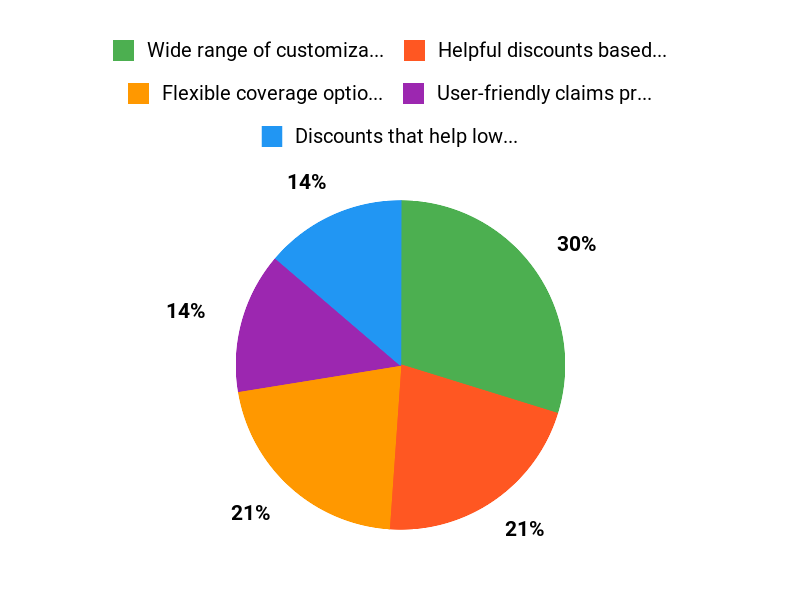

Pros |

Cons |

|---|---|

✅ Wide range of customizable coverage options |

❌ Some users find the online quote tool a bit slow |

✅ Helpful discounts based on driving patterns |

❌ Availability of certain discounts may vary by location |

✅ User-friendly claims process |

|

✅ Reliable customer service |

People appreciate how easy it is to customize their coverage and value the transparent claims experience. Many highlight how the discounts reflect their actual driving behavior, saving money especially during the busy holiday season.

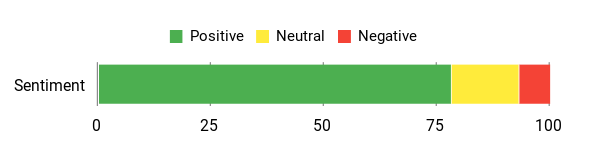

Overall Sentiment: Positive

🗣️ DriverAmy92

I’ve had Allstate for a couple of years, and the personalized quotes really helped me find a plan that fits my driving habits. The claims process was straightforward when I had a minor accident, and they kept me updated every step of the way.

🗣️ RoadTripRory

The discounts made a noticeable difference, especially since my driving changed around the holidays. I appreciate how Allstate covers everything from liability to collision, so I feel secure no matter where I’m headed.

Allstate’s approach rewards you for safe driving and lets you adjust coverage as your needs change, which can reduce long-term costs. Staying on top of discounts and updating your plan seasonally means you won’t be stuck paying for coverage you don’t use.

The personalized coverage and various discounts mean you get protection tailored to your lifestyle, which often translates into better value than one-size-fits-all plans. The peace of mind during holiday travels especially makes it worth it.

Situation |

How It Helps |

|---|---|

Holiday Road Trips |

Adjust your coverage to include more comprehensive protection for longer distances and unpredictable weather. |

Daily Commute |

Choose liability options that cover everyday driving without unnecessary extras. |

Winter Weather |

Collision coverage helps with damages from slippery roads or fender benders during snowy conditions. |

Low Mileage Periods |

Discounts apply when you drive less, saving you money during slower travel times. |

Feature |

Ease Level |

|---|---|

Online Quote Tool |

Moderate |

Claims Filing Process |

Easy |

Customer Support |

Easy |

Policy Customization |

Moderate |

Allstate offers a broad range of coverage types and discounts, making it easy to tailor your insurance to exactly what you need, whether you’re a cautious commuter or an adventurous holiday traveler.

Feature |

Customization Level |

|---|---|

Coverage Types (liability, collision, comprehensive) |

High |

Discounts Based on Driving Behavior |

Medium |

Add-on Services (roadside assistance, rental coverage) |

Medium |

Adjustable Deductibles |

High |

Allstate has a long-standing reputation for reliable service and clear communication, which adds confidence when you’re making choices about your auto coverage.

The streamlined claims process and responsive customer support help you quickly manage accidents or damages without added stress, which is especially important during busy travel seasons.

Rating: 4.5

See PricingYou face unique driving challenges during the holiday season, such as increased traffic and longer trips to visit family and friends. Personalized auto coverage allows you to tailor your policy to your specific needs, helping you stay protected in these situations.

For example, you can choose comprehensive coverage that guards against weather-related damages, or collision coverage if you anticipate more city driving. Adjusting your coverage now ensures you pay only for what you need and receive the best protection when it matters most.

When selecting your coverage, consider the type and length of your holiday trips. If you're driving through areas prone to winter weather, comprehensive coverage is important.

Liability coverage remains essential in case of accidents, especially with heavier traffic. You should also review whether your policy includes roadside assistance, which can save you time and stress on busy holiday roads.

Getting a personalized quote helps you understand your options and make informed decisions based on your travel plans and vehicle usage.

To maximize your benefits, review your policy details well before your holiday trips. Make sure your coverage limits align with your current driving habits.

If you haven’t already, ask about available discounts—some companies offer savings for safe driving or bundling policies. Keep your insurance information handy during travel and understand the claims process in case of an incident.

With personalized coverage, you get flexibility and peace of mind so you can focus on enjoying the holiday season stress-free.

You should choose Allstate Auto Insurance because it offers personalized coverage options that adapt to your unique driving habits and holiday travel needs, ensuring you’re protected without paying for unnecessary extras. With flexible plans and reliable support, you can feel confident knowing your vehicle and loved ones are safeguarded during the busy holiday season.

Navigating auto coverage during the holidays means making sure your insurance matches your travel plans and usage. With personalized options like those offered by Allstate, you can benefit from tailored protection that fits your budget and lifestyle.

Choosing the right coverage not only safeguards you on the road but can also save you money by applying relevant discounts. By understanding these options, you will be well-prepared for the holiday season and the unexpected moments that come with it.

Shield your trading cards this New Year with our top picks for sleeves, ensuring maximum protection and preservation for your valuable collection.

Find the perfect baseball card storage boxes this holiday season with essential tips on size, material, and organization to protect your valuable collection.

Uncover the best Dyson cordless vacuums of 2025, featuring powerful suction, advanced filtration, and innovative designs for effortless cleaning.